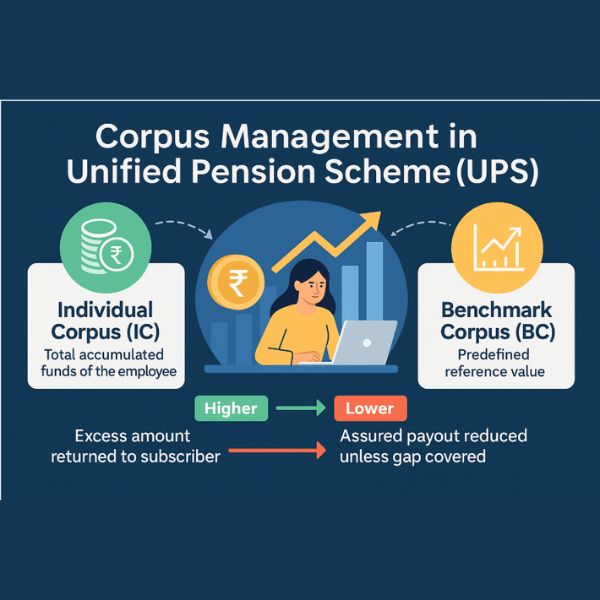

The UPS Pension Scheme offers a range of benefits that make it an attractive option for government employees. The Unified Pension Scheme (UPS) is a ‘fund-based’ payout system under the National Pension System (NPS) for Central Government employees, relying on the regular and timely accumulation and investment of applicable contributions for granting monthly payouts to retirees. The management of these contributions involves distinct concepts: the Individual Corpus, the Pool Corpus, and the Benchmark Corpus.

Here’s what the sources say about corpus management within the UPS:

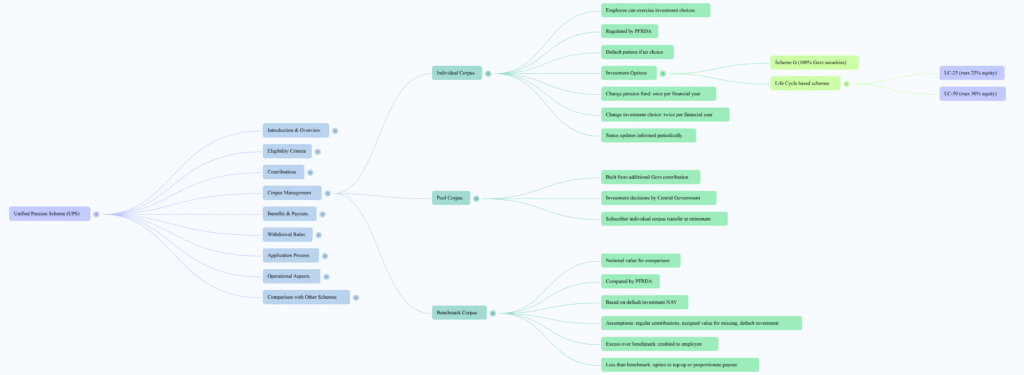

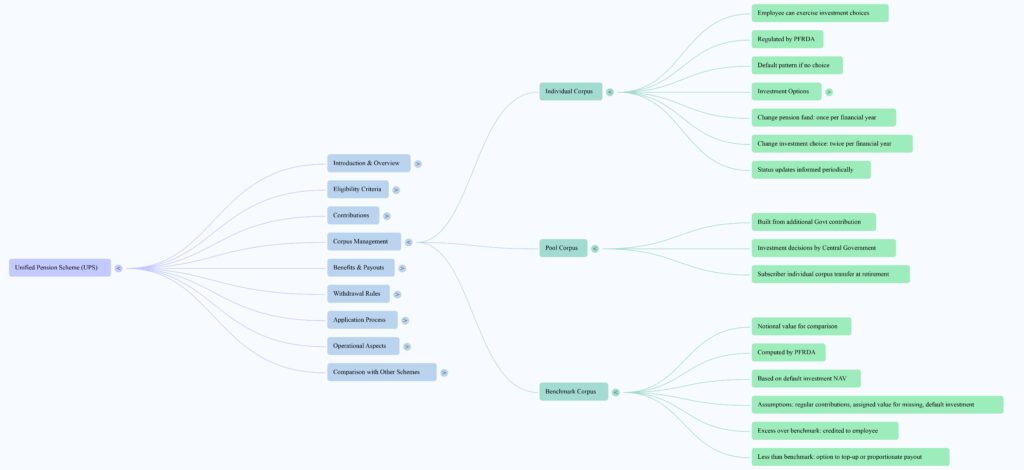

Individual Corpus

Definition and Contributions:

The Individual Corpus refers to the value of the corpus available in a subscriber’s Permanent Retirement Account Number (PRAN) under UPS. Both the employee and the Central Government contribute 10% of (basic pay + Dearness Allowance) to this individual corpus, which is credited to each employee’s PRAN. If an employee migrates from NPS to UPS, their existing corpus gets transferred to the PRAN tagged to UPS.

Investment Choices:

Employees have the flexibility to exercise investment choices for their individual corpus, which are regulated by the Pension Fund Regulatory and Development Authority (PFRDA). If an employee does not make an investment choice, a ‘default pattern’ of investment defined by PFRDA will apply. Options for investment choices other than the default pattern include investing 100% in Government securities (Scheme G) or choosing from Life Cycle based schemes like LC-25 (maximum 25% equity) or LC-50 (maximum 50% equity).

Changing Investment Choices:

A UPS subscriber has the option to change their choice of pension fund once in a financial year and their investment choice twice in a financial year.

Tracking:

The value or units in the individual corpus with investment choices are informed to the employee on a periodic basis.

Pool Corpus

Definition and Contributions:

The Pool Corpus is a consolidated fund primarily built from three sources. The Central Government provides an additional contribution of an estimated 8.5% of (basic pay + Dearness Allowance) of all employees who have chosen the UPS option, to the pool corpus on an aggregate basis. This additional contribution is specifically for supporting assured payouts under the UPS option. Furthermore, after an employee superannuates or retires, their remaining balance (or a portion of it, equivalent to the benchmark corpus) can be transferred from their individual PRAN into this central Pool Corpus.

Investment Management:

Unlike the individual corpus, the investment decisions for the pool corpus solely rest with the Central Government.

Disbursement Role:

The National Pension System Trust authorizes the transfer of the balance in the individual corpus to the pool corpus upon receipt of the UPS Payout Order. The Trust also ensures the payment of monthly payout from the Pool Corpus to the subscriber’s bank account and periodic release of applicable dearness relief.

Benchmark Corpus

Definition and Purpose:

The Benchmark Corpus is a notional value computed by the CRA (Central Recordkeeping Agency) for comparison with the individual corpus. It is defined as a corpus value accrued through a default pattern of investment as defined by PFRDA. Its purpose is to assess the adequacy of an individual’s retirement savings.

Computation:

The ‘benchmark corpus’ value is computed with assumptions that include regular contributions by employees and the employer, appropriate value assignment for missing contributions, and investment of such contributions as per the PFRDA’s ‘default pattern’ of investment.

Treatment at Retirement:

If the value or units of the individual corpus is more than the value or units of the benchmark corpus, the employee authorizes the transfer of value/units equivalent to the benchmark corpus to the pool corpus, and the balance amount in the individual corpus will be credited back to the employee.

If the value or units of the individual corpus is less than the value or units of the benchmark corpus, the employee has an option to arrange for additional contribution to meet this gap. If the gap is not met, the assured payout may be proportionately reduced.

Past retirees of NPS who superannuated before UPS became operational will be paid arrears and a monthly top-up amount after adjusting for withdrawals and annuities, as determined by PFRDA, without directly transferring their individual corpus to the pool corpus.

Withdrawal Rules and Impact on Corpus/Payout

Final Withdrawal at Retirement:

A UPS subscriber can opt for a final withdrawal of up to 60% of the individual corpus or benchmark corpus, whichever is lower, at the time of superannuation or retirement. However, this withdrawal is subject to a proportionate reduction in the assured payout payable to the subscriber. This withdrawal is admissible on the date of superannuation, voluntary retirement, or retirement under FR 56(j).

Partial Withdrawals During Service:

Employees can make partial withdrawals up to three times during their service, after completing a lock-in period of three years from the date of enrollment under UPS or NPS. Each withdrawal is limited to 25% of the self-contribution (excluding returns) and is allowed for specified purposes like higher education or marriage of children, purchase/construction of a residential house, medical emergencies, disability-related expenses, and skill development. Subscribers also have the option to replenish the partially withdrawn amount before retirement to maintain full pension benefits.

Loss of Benefits:

If an employee is removed or dismissed from service, or resigns, the option of assured payout under UPS is not available. In such cases, the employee’s contributions will follow NPS rules, and the corpus remains in their NPS account; the government’s 18.5% contribution stops, and withdrawals are subject to NPS guidelines.